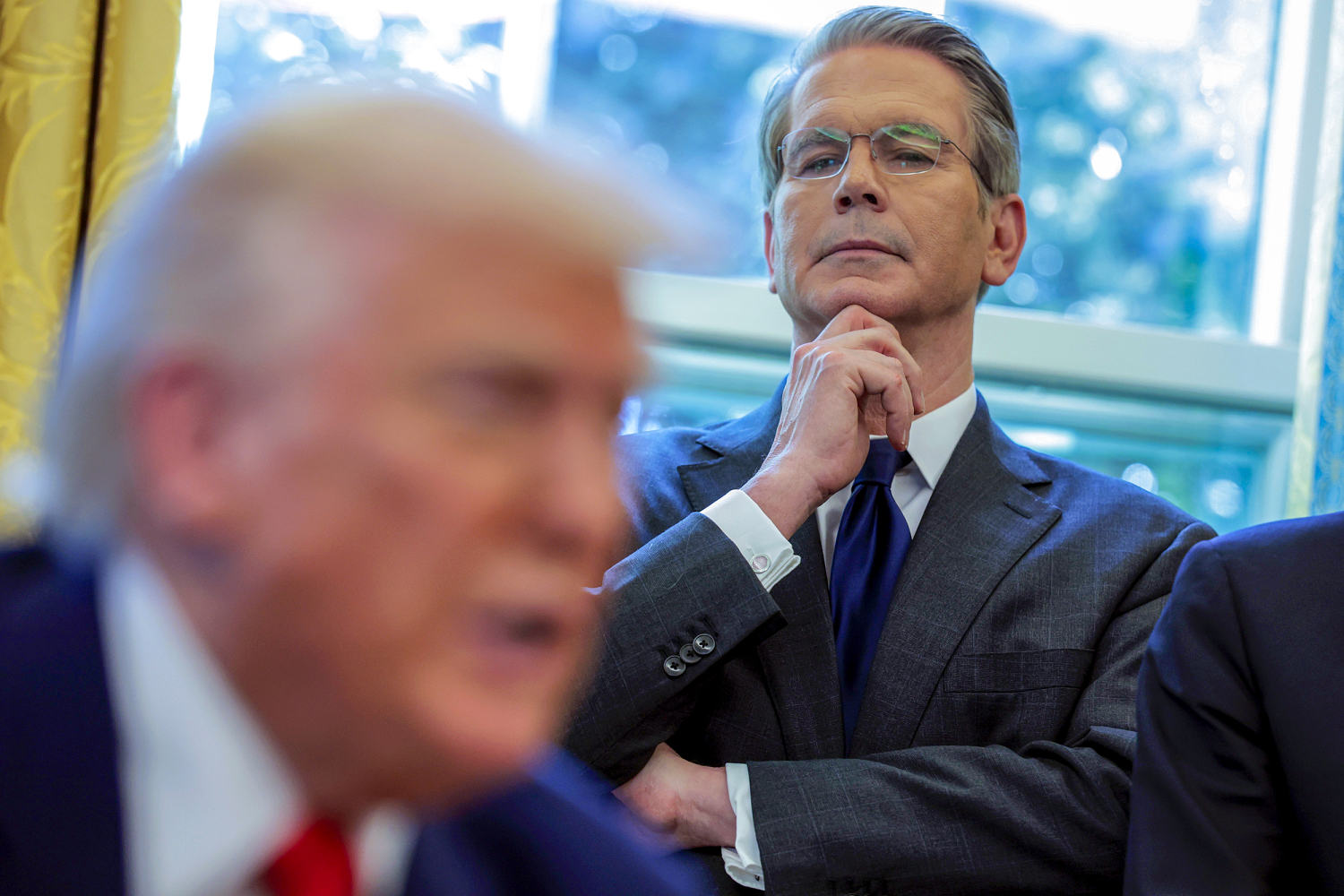

Treasury Secretary Scott Bessent said Wednesday that while the Trump administration was committed to playing an active role in global financial institutions, it remained focused on addressing large trade imbalances — especially with China, whose economic model Bessent called “unsustainable.”

Bessent’s remarks came amid some growing optimism that President Donald Trump has begun to show signs of softening his tariff push as well as his attacks on Fed Chair Jerome Powell. But Bessent did little to indicate a near-term change to the combative stance with the rest of the world that Trump has taken since returning to office.

While Bessent said that “more than 100 countries” have now approached the U.S. to address trade imbalances, he reasserted a key Trump talking point that the rest of the world — as well as past U.S. presidents — were responsible for harming America’s heartland.

“For decades, successive administrations relied on faulty assumptions that our trading partners would implement policies that would drive a balanced global economy,” Bessent said. “Instead, we face the stark reality of large and persistent U.S. deficits as a result of an unfair trading system.”

He continued: “Intentional policy choices by other countries have hollowed out America’s manufacturing sector and undermined our critical supply chains, putting our national and economic security at risk.”

Trump has said he views America’s large trade deficits as a sign that the country is being “ripped off” — a view that other economic commentators dispute, saying the deficits merely reflect that the U.S. simply consumes more goods from around the world than it produces.

The deficit is especially large with China. And while Trump had raised the tariffs rate against imports from that country to as high as 145%, Bessent has signaled the administration’s aggressive posture toward China would likely relax, telling a group of investors Tuesday that the administration was now looking for a “de-escalation” with China, adding that the current situation was “not sustainable,” according to CNBC.

On Wednesday, The Wall Street Journal reported that the White House was now looking to slash potential tariffs by as much as half, with stiffer duties left in place for essential goods — though all would be phased in more slowly.

In response, a White House spokesperson said the administration continued to negotiate with China.

“President Trump has been clear: China needs to make a deal with the United States of America,” White House spokesman Kush Desai said in a statement. “When decisions on tariffs are made, they will come directly from the President. Anything else is just pure speculation.”

While the likely softening toward China has helped settle markets, investors remain skittish about the precedent set by Trump’s erratic policymaking.

Other global players are looking to step into the breach Trump has created. In Wednesday remarks, a European Union official said the region was using its “predictability as a strength” as it sought stronger relations with other nations.

“In times of turmoil, predictability, the rule of law and upholding the rules-based international order become Europe’s greatest assets,” said Valdis Dombrovskis, the EU’s Commissioner for Economy and Productivity, in a post on X.

He also told the Wall Street Journal that the EU would not budge on its value-added tax, nor on the agricultural subsidies it provides to the region’s farmers — both targets of Trump criticisms.

Bessent, a former hedge fund manager, has been viewed as the White House’s key liaison to Wall Street. He and Commerce Secretary Howard Lutnick were instrumental in persuading Trump to pursue a 90-day pause in the country-by-country tariffs Trump announced earlier this month. Key U.S. financial figures seemed to have been aware the Bessent’s stock was rising as the White House wrestled with the market meltdown that the tariffs’ announcement had set off.

“Let Scott take the time” to negotiate, JP Morgan CEO Jamie Dimon told Fox News Business just before the pause was announced April 9.

A week later, Bessent told Bloomberg TV that the worst of the market volatility had “likely peaked” as he signaled an “orderly process” on tariff negotiations ahead.

Bessent has also come out ahead after an apparent power-struggle with Elon Musk culminated last week in the replacement of Musk’s pick to head the Internal Revenue Service by a Bessent deputy — just days after the Musk choice had been appointed.

“Trust must be brought back to the IRS, and I am fully confident that Deputy Secretary Michael Faulkender is the right man for the moment,” Bessent said in a statement, adding that Gary Shapley would remain a top adviser to him on IRS reform.

Latest World Breaking News Online News Portal

Latest World Breaking News Online News Portal