Stephanie Nixdorf was at Disney World with her family in December 2021 when she got the call. A mysterious bump on her elbow was melanoma, her doctor said. Tests later showed it was Stage 4, with spots on her lung and two tumors in her brain.

Nixdorf, 51, a mother of four who lives with her husband, Jason, in Davidson, North Carolina, began treatments immediately, and by January 2024 her cancer was abating. The Premera Blue Cross health insurance offered by her husband’s employer had covered her cancer care, but in early 2024, when Stephanie’s doctors prescribed a drug to battle crippling arthritis induced by her immunotherapy treatments, the denials began.

“I used to run, play tennis, be active,” Nixdorf told NBC News. “Now I can’t even open a yogurt or grip a steering wheel in the morning.”

Premera Blue Cross, a not-for-profit licensee of the Blue Cross Blue Shield Association in Mountlake Terrace, Washington, is a leading health plan in the Pacific Northwest, serving 2.5 million people. For nine months in 2024, it denied repeated requests by Nixdorf’s doctors to cover infliximab, an inflammatory arthritis drug they’d prescribed.

With his wife in agony, Jason Nixdorf had a chance encounter with Zach Veigulis, a former chief data scientist at the Department of Veterans Affairs who was co-founding a company to help patients battle insurance company denials. That company, Claimable Inc., built an AI platform that allows patients to generate customized appeal letters containing comprehensive assessments of clinical research on a drug or treatment and other patients’ appeals history with it. The cost: around $40.

When Nixdorf reached out, Claimable’s site was not yet live, but its chief executive and co-founder, Dr. Warris Bokhari, offered to help write an appeal letter for Stephanie using they system they had developed.

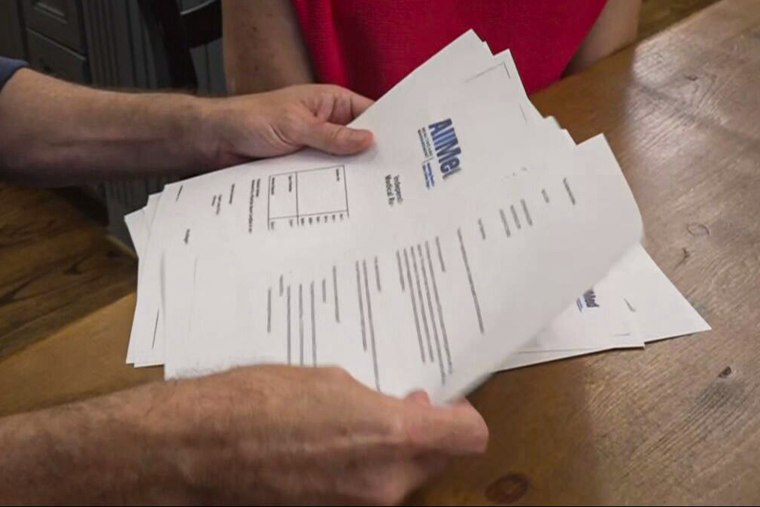

In mid-September 2024, she sent that 23-page appeal letter to Premera’s chief executive and chief legal counsel, arguing that one of its own policies states it should cover infliximab, her records show. Her letter also went to the governor and attorney general of North Carolina, officials at the Department of Health and Human Services, the Consumer Financial Protection Bureau and the Wage and Hour Division of the Department of Labor.

Two days later, Premera approved the drug. “I want to apologize that you have been waiting to receive treatment for nine months,” the approval letter said.

Nixdorf is one of a growing cohort of patients using artificial intelligence to battle health insurance denials. Several companies offer software programs that let patients create comprehensive appeal letters relatively quickly, with the help of AI. It scrapes the internet for every shred of evidence of drug efficacy and past appeals success in a fraction of the time it would take a human to do.

Courtney Wallace, a Premera spokeswoman, provided a statement to NBC News on the Nixdorf case.

“There was no intent to deny care,” she said. Rather, Premera made a “processing error involving a misapplication of policy and assignment to an incorrect physician specialist.”

Premera “fell short” in this case, Wallace added.

Research shows the arthritis Stephanie was experiencing, if untreated, can cause irreversible joint damage and significant disability.

Jason Nixdorf said he’s relieved that his wife was able to receive coverage for a treatment her doctors prescribed, but he also feels angry over the ordeal and its consequences.

“Not only has the delay caused Stephanie permanent damage,” he said, “it will be a lifelong thing for her to deal with this arthritis. If we had gotten the OK in January, it could have been knocked out and done then.”

‘People give up’

As many patients and their doctors know, trying to gain insurance coverage for a drug or treatment can be a full-time and exasperating task. Comprehensive data on insurance company denials is unavailable, but a January 2025 study by KFF, a health policy research, polling and news organization, found that insurers participating in so-called marketplace plans under the Affordable Care Act denied 19% of in-network claims in 2023, the most recent year for which data is available. Fewer than 1% of consumers appealed the denials, the research found, and when they did, over half the denials — 56% — were upheld.

In addition to the impact insurance company denials have on patients’ health, they carry a financial cost. In a 2023 KFF survey, 39% of consumers who were having trouble paying their medical bills said denied claims contributed to their problems.

Amid the fight over Premera’s denials, the Nixdorfs and their doctors repeatedly tried to set up a case review by calling a toll-free number that was never answered by a human being, leaving messages that were not returned, faxing paper documents at Premera’s request, and completing letters of medical necessity.

Wallace, the Premera spokeswoman, agreed there had been “a breakdown in communication” in the Nixdorf case. “We’re focusing on providing a better experience for providers,” she added.

Nixdorf’s documents show Premera’s first denial came in February when the insurer said infliximab was “not medically necessary” to treat her arthritis. A second denial in June characterized the drug as “investigational or experimental,” even though it is recommended for inflammatory arthritis by the National Comprehensive Cancer Network Drugs and Biologics Compendium, a bible among oncologists. The third denial, in July, said infliximab was not Food and Drug Administration-approved.

“They set the system up so people give up,” Jason said.

After the third denial, Jason requested Premera provide all the records relating to its decision. He and his wife became even more troubled when they received the materials, learning, for example, that the doctor used by Premera in what’s known as a peer-to-peer review of the case was a specialist in internal medicine with no expertise in cancer or inflammatory arthritis.

They also discovered the company contracted by Premera to do an independent review of their case — AllMed Healthcare Management — was led by Jeff Card, who had been director of clinical review operations at Premera for seven years until he joined AllMed in 2021, his LinkedIn biography says.

Having his wife’s case reviewed by a company overseen by a former Premera executive presented a conflict of interest, Nixdorf told NBC News.

Premera’s spokeswoman declined to respond to this criticism, saying “AllMed is accredited by both the National Committee for Quality Assurance and the Utilization Review Accreditation Commission.” Premera’s partnership with AllMed is “subject to rigorous oversight, including quarterly reviews and audits” by the insurer, Wallace said.

AllMed did not return an email and a phone call seeking comment from the company and from Card.

Veigulis of Claimable said the company’s three co-founders, including Alicia Graham, wanted to understand why people who have access to health care don’t receive it. Building their AI model that went live last October, they began with rheumatology and migraine and now cover over 50 life-changing treatments. Veigulis said roughly 1,000 denials have been overturned by patients using the Claimable model.

“We see so many people who have met the eligibility criteria who pay their premiums on time that still can’t access their health care,” he said. “It is wild.”

‘You have rights’

Tabitha Lee is a former paramedic working in rheumatology at Wilmington Health in North Carolina. Since January, she has handled prior authorization and insurance denials for the roughly 100 patients who come in each day.

Denials have ramped up recently, she said.

“We’ve had a lot of patients on medication for years, stable and well-controlled, and insurances were denying them,” Lee told NBC News. Instead, the insurers would suggest alternative drugs that were on their approved lists, or formularies, she said. This was causing trouble for patients, Lee added, because “changing patients’ medications can cause adverse reactions.”

Lee said she had tried filing appeal letters for patients but it was time-consuming to compile the scientific and clinical testing data on each case. In February, at the suggestion of a rheumatologist and adjunct professor at the Duke School of Medicine, she began filing appeals using an AI-generated system created by Counterforce Health, a nonprofit founded by Neal K. Shah, a former hedge fund manager turned health care entrepreneur and advocate. Shah is also chief executive of CareYaya Health Technologies, a nonprofit that connects college students pursuing health care degrees with families seeking care for aging relatives.

At no charge, Counterforce generates customized appeal letters based on a patient’s insurance policy and the current record of successful appeals related to the drug or treatment in question. The letters also go to insurance regulators in the patients’ states to alert them to the denials, which Shah said they may not be aware of.

“Denials should be appealed, but we observe most people don’t appeal because they are intimidated by whole thing,” Shah said. His message to patients: “When you get a no, please take the next step — you have rights.”

Lee said using the Counterforce software has helped her overturn denials. “I’ve gotten back approvals on the same day and the day after,” Lee said. “It definitely limits the time we have to spend formulating each denial letter and allows me to work more on initial prior authorization and patient assistance.”

Latest World Breaking News Online News Portal

Latest World Breaking News Online News Portal