WASHINGTON — As Senate Republican leaders push to a massive bill for President Donald Trump’s agenda by July 4, they are juggling a host of competing demands.

Some senators are genuine threats to vote against the legislation, while others are expected to support it in the end after using their demands to shape it. Several of them have complicated political considerations. The Republicans who are speaking out most loudly point to a variety of ways the House-passed bill may change in the Senate, as party leaders seek to ease enough of their concerns.

With all Democrats expected to vote against the package, Republicans will need at least 50 votes to pass it, as Vice President JD Vance could break a tie.

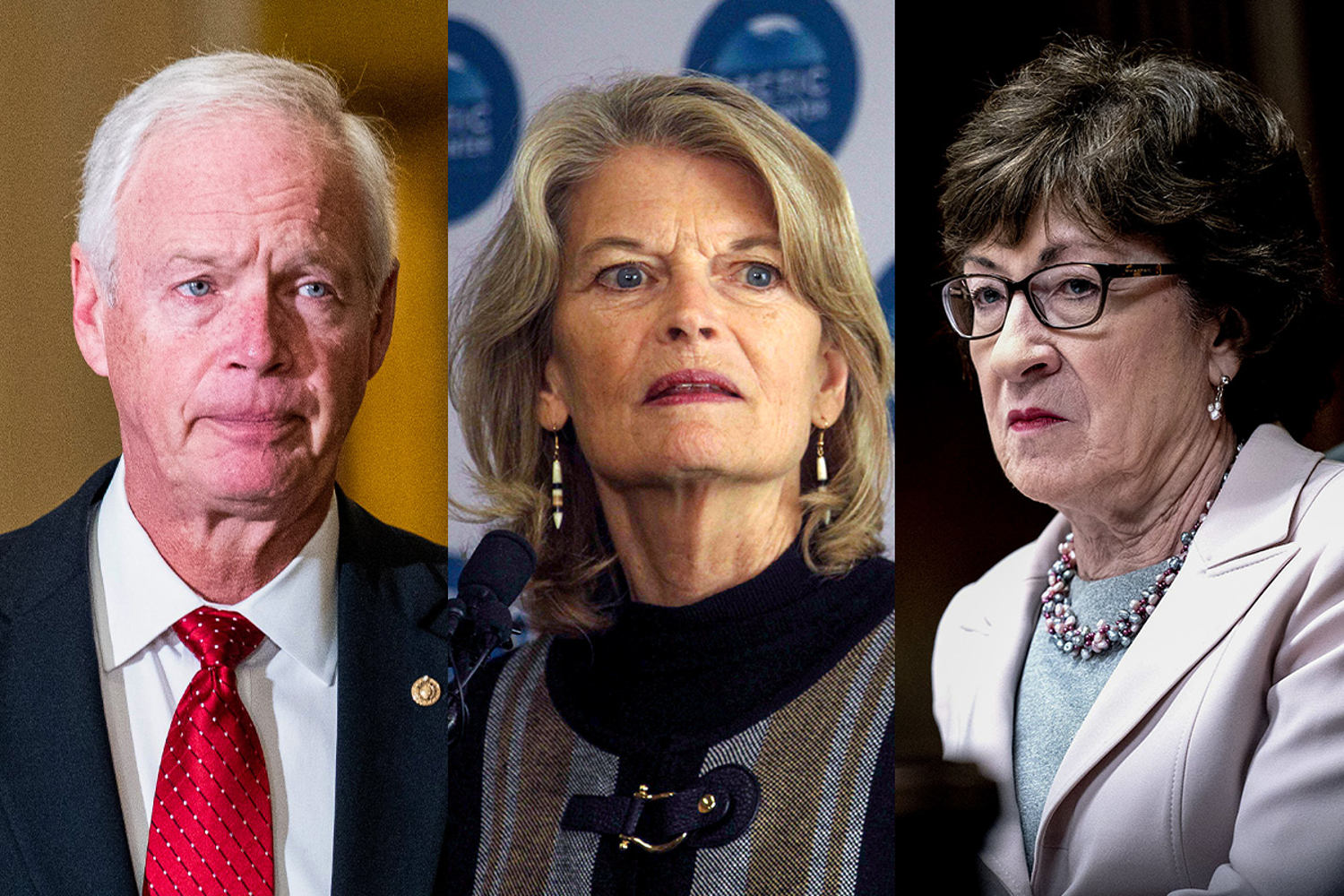

Here are seven key senators to watch.

Rand Paul

Sen. Rand Paul, R-Ky., is the only Republican senator who has voted against this legislation every step of the way. He has blasted the spike in military spending, the huge increase in deficits and, in particular, the $5 trillion debt limit hike. Paul does support a key part of the package — an extension of the Trump’s 2017 tax cuts — but he wants to offset it with trillions of dollars in additional spending cuts, which the GOP has no hope of finding consensus on.

Paul typically doesn’t play games with his red lines. Barring an uncharacteristic about face, expect him to vote against the bill.

Susan Collins

Sen. Susan Collins, R-Maine, is the sole surviving GOP senator to represent a state that Democrats consistently win at the presidential level. And she faces re-election this year. Her trajectory has been revealing, from supporting the initial budget resolution to voting against the revised version. A key reason for her opposition? Concerns that the Medicaid cuts would harm low-income and elderly constituents.

She also expressed reservations about going after waste and fraud in Medicare, as GOP leaders have begun to consider. In addition, Collins and others like Sen. John Curtis, R-Utah, would firmly oppose overruling the parliamentarian, the Senate’s in-house referee who settles rule disputes, if she disqualifies some policies.

Collins voted for the party’s 2017 tax law, but she has been willing to vote against major GOP bills in the past. Party leaders will need to take her demands seriously in order to win her vote.

Lisa Murkowski

When Sen. Lisa Murkowski, R-Alaska, voted for the budget blueprint in April that kickstarted the process of writing the legislation, she quickly followed it up with a broad set of grievances that will need to be addressed, or she’ll be “unable to support” the final product. Among other things, she took issue with Medicaid cuts and an accounting trick her party is using to obscure the cost of the tax cuts.

Two months later, her concerns persist. Asked Thursday by NBC News what she wants to change in the emerging bill, Murkowski replied dryly, “Oh, I’ll give you a list.”

Murkowski has criticized the phaseout and repeal of clean energy tax credits that benefit her state, writing a letter in April with three of her colleagues — Sens. Jerry Moran, R-Kansas, Thom Tillis, R-N.C., and Curtis — highlighting the importance of America’s energy independence, which they argued could be weakened as a result of this bill.

Murkowski has shown an independent streak and a willingness to take political arrows when standing her ground.

Mike Crapo

Sen. Mike Crapo, R-Idaho, is the chairman of the Senate Finance Committee and will help craft some of the biggest and most contentious pieces of the bill — including the tax cuts and Medicaid cuts. Despite his soft-spoken and non-confrontational style, Crapo won’t be able to make everybody happy.

And any changes he makes in the Senate would have to be palatable to the wafer-thin House Republican majority, which engaged in painstaking negotiations before passing its version of the bill by a one-vote margin.

One example of the disconnect is the expanded $40,000 cap on state and local tax deductions, to placate a group of blue-state House Republicans. But there are no GOP senators representing blue states where that is a big issue. Crapo said “there’s not a strong mood in the Senate Republican caucus right now” to expand SALT.

The bill represents his biggest test since taking the powerful gavel.

Thom Tillis

Sen. Thom Tillis, R-N.C., said he wants to adjust the phaseouts of the clean energy tax credits with a more “targeted” approach to protect U.S. businesses that are already invested in existing projects. He said there’s “general consensus that the House proposed language will be modified.” Senate Environment and Public Works Chair Shelley Moore Capito, R-W.Va., agreed, telling NBC News some phaseouts will likely be pushed back.

A member of the Finance Committee, Tillis has sounded generally positive about the direction of the bill, making him a likely “yes” vote. But he’s skeptical that the Senate will meet the Independence Day deadline: “There’s a lot of things that have to go perfectly right to get all that done and be out by July 4.”

Tillis faces a tough political balancing act: He’s up for re-election next year in a state that Democrats will be targeting; but first he needs to get through a Republican primary, which means staying on Trump’s good side.

Ron Johnson

Sen. Ron Johnson, R-Wis., has railed against the bill and its estimated $2.4 trillion contribution to the deficit, insisting he can’t vote for it as written. He has slammed the idea of a mega-bill, calling for breaking it up and limiting the debt ceiling hike.

Trump asked him to be “less negative” during a meeting at the White House on Wednesday, Johnson said.

“I think we had a good, lively discussion between the two of us,” Johnson told NBC News. “He obviously would like me to be a little less negative, a little more positive, which I’m happy to do.”

Johnson said he isn’t trying to make Trump and GOP leaders’ jobs harder. And the senator zig-zagged his way to “yes” on the 2017 tax law after initially coming out against it, so party leaders have reason to be optimistic that he won’t sink this legislation.

Josh Hawley

Sen. Josh Hawley, R-Mo., has been the Senate GOP’s most vocal opponent of cutting Medicaid “benefits” — and he’s been specific about which parts of the House bill he’s worried about, citing the Medicaid provider tax and cost-sharing provisions.

Notably, Hawley said he’s fine with coverage losses resulting from Medicaid work requirements and expanded proof-of-eligibility provisions. Those make up the bulk of the House bill’s savings.

Hawley has also expressed reservations about including any provisions in the bill related to Medicare, which Republicans recently said they would discuss related to savings connected to so-called “waste, fraud, and abuse.” Hawley called that “a terrible idea,” telling reporters Thursday, “If you don’t ever want to win an election again, just go fiddle around with people’s Medicare that they’ve worked hard for, paid into.”

Latest World Breaking News Online News Portal

Latest World Breaking News Online News Portal