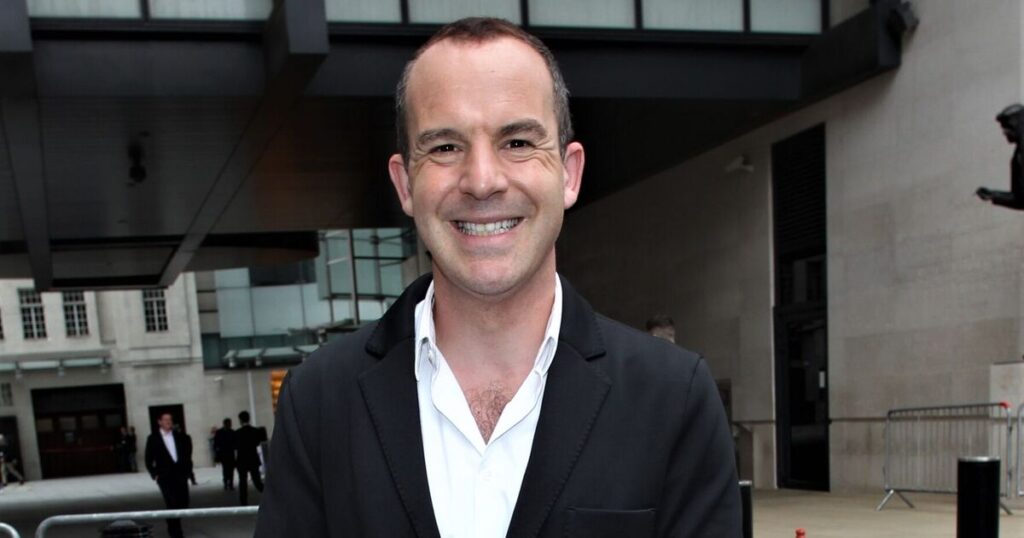

Money expert Martin Lewis has issued an update to potentially millions of Brits who would be owed a more than £1,000 payout. The finance guru advised that more information could be coming in a couple of months.

Millions across the UK who secured car finance before 2021 could be in line for a compensation windfall averaging £1,100 if the Supreme Court rules that firms’ undisclosed commissions led customers to lose out.

The case, appealed after a judgment by the Court of Appeal, was presented to the apex court in April.

Consumer champion Martin Lewis, alongside his MoneySavingExpert team, initially brought attention to Financial Conduct Authority (FCA) investigations into former practices involving motor finance Discretionary Commission Arrangements (DCAs) last year.

Martin, taking to social media on Monday, expressed that while there has been no update on the verdict, expectations suggest a decision might arrive by July.

In a message posted on X, formerly known as Twitter, the financial expertsaid: “What’s happening with car finance reclaiming? I’m being asked this a lot. No update I’m afraid, the Supreme Court case has been heard and everything is now waiting for its decision. There is no way to know when that’ll happen but many I speak to have a working assumption it’ll be July.”

As reported by the Daily Record, Martin previously projected that around 40% of all car financing arrangements inked between April 2007 and January 28, 2021, might necessitate approximately £1,100 in reparation.

This potential reimbursement encompasses individuals who used ‘hidden DCA charge’-tainted finance options to acquire vehicles including vans, campervans or motorcycles within said timeframe.

As of now, the FCA plans to withhold any statements until the Supreme Court makes its ruling public.

Back in March, the FCA disclosed its intentions to deliberate on an “industry-wide redress scheme” within a timeframe of six weeks post the Supreme Court’s verdict.

At that juncture, the Authority commented: “We are currently reviewing the past use of motor finance Discretionary Commission Arrangements (DCAs). We’re seeking to understand if firms failed to comply with requirements relating to DCAs and if consumers lost out as a result. If they have, we want to make sure consumers are appropriately compensated in an orderly, consistent and efficient way.”

The regulator elaborated that the inception of their review last year coincided with a decision by the Court of Appeal, which “raised the possibility of widespread liability among motor finance firms wherever commissions were not properly disclosed to customers”.

Continuing on, the FCA indicated: “The Supreme Court will hear an appeal against the Court of Appeal’s judgment on 1 to 3 April. We have been granted permission to intervene in the case and have filed our submission with the Court.”

In aiming to solidify a sense of certainty for all parties involved, the FCA announced: “We want to provide as much certainty as possible to firms, consumers and stakeholders. So, we are confirming that if, taking into account the Supreme Court’s decision, we conclude motor finance customers have lost out from widespread failings by firms, then it’s likely we will consult on an industry-wide redress scheme.”

They previously acknowledged the heightened likelihood of instating an alternative mechanism for handling complaints since the beginning of their review.

According to the FCA, the proposed redress scheme would put the onus on firms to determine whether customers had suffered losses as a result of their failures. If so, the firms would be required to offer suitable compensation, with the regulator establishing guidelines and safeguards to ensure compliance.

The FCA elaborated: “A redress scheme would be simpler for consumers than bringing a complaint. We would expect fewer consumers to rely on a claims management company, meaning they would keep all of any compensation they receive. It would also be more orderly and efficient for firms than a complaint-led approach, contributing to a well-functioning market in the future.”

Latest World Breaking News Online News Portal

Latest World Breaking News Online News Portal