Just about everything is going wrong for our beleaguered Chancellor.

She’s been humiliated by the Prime Minister, who publicly reversed her decision to axe the winter fuel payment for 10 million pensioners.

Now she’s under pressure from deputy PM Angela Rayner, who is pressing for sweeping tax hikes and no more spending cuts.

Wednesday’s shock inflation figure didn’t help, with many blaming that on Reeves’ own economic policies.

Even the one piece of good news – a surprise 0.7% rise in first-quarter GDP – was driven by exporters rushing to ship goods to the US ahead of new Trump tariffs.

With tariffs now in force, growth looks set to vanish again.

But none of that compares to what may now be heading her way.

A global storm is brewing. It began in Japan, is hammering the US, and has just touched British shores.

UK borrowing costs have spiked. They’re now higher than during Liz Truss’s calamitous premiership.

In fact, they’ve just hit their levels seen in the darkest days of 2008, when the financial crisis brought the global economy to its knees.

This threatens to throw the Chancellor’s entire economic strategy into chaos.

Every so often, I check UK government bond yields – the interest rate we pay on the national debt. What I saw today made me sit up.

Yields on 30-year gilts hit 5.65% this afternoon. That’s the highest they’ve been in 17 years, when the banking system was on the verge of collapse.

In 2008, central banks only stopped the bleeding by slashing interest rates to zero and printing eye-watering sums of money.

We lived with the fallout for years. Now, the bond market is back on the rampage.

As I’ve said before, the bond market is the most powerful force in the world. When it talks, everybody pays attention, even Donald Trump.

The world is drowning in debt and bond investors are starting to say enough is enough.

In Japan, where debt stands at 240% of GDP, the so-called “bond vigilantes” have gone on strike, as they fear Japan will default and they won’t get their money back.

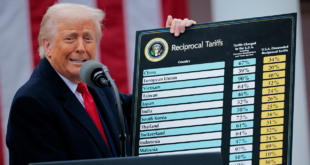

Trump’s latest move is making things worse. His “big, beautiful bill” aimed at slashing taxes may add another $3.3trillion to America’s $36trillion (£27trillion) debt mountain.

Bond buyers are demanding more interest before lending to Trump’s spendthrift America. Yields on long-term 30-year US bonds, known as Treasuries, have shot past 5%.

According to one financial expert, this could send inflation rocketing to 25%.

Which brings us to Reeves. UK gilt yields are spiking too, because so-called “bond vigilantes” don’t trust her to deliver growth or control spending.

The UK is already spending an absolute fortune on debt interest, a staggering £9billion in the last month alone.

That’s more than double what we spend on defence.

As gilt yields rise, that figure will balloon. And Reeves will be forced to act.

That means tax rises, spending cuts or more likely, both in the autumn Budget. Just to stop the wheels falling off.

Yields might settle. Growth might recover. But if the bond market keeps tightening its grip, Reeves could face a full-blown fiscal crisis.

Keep an eye on the 10-year gilt chart. It’s not just Rachel Reeves who should be sweating at the sight of it – we all should be.

Latest World Breaking News Online News Portal

Latest World Breaking News Online News Portal