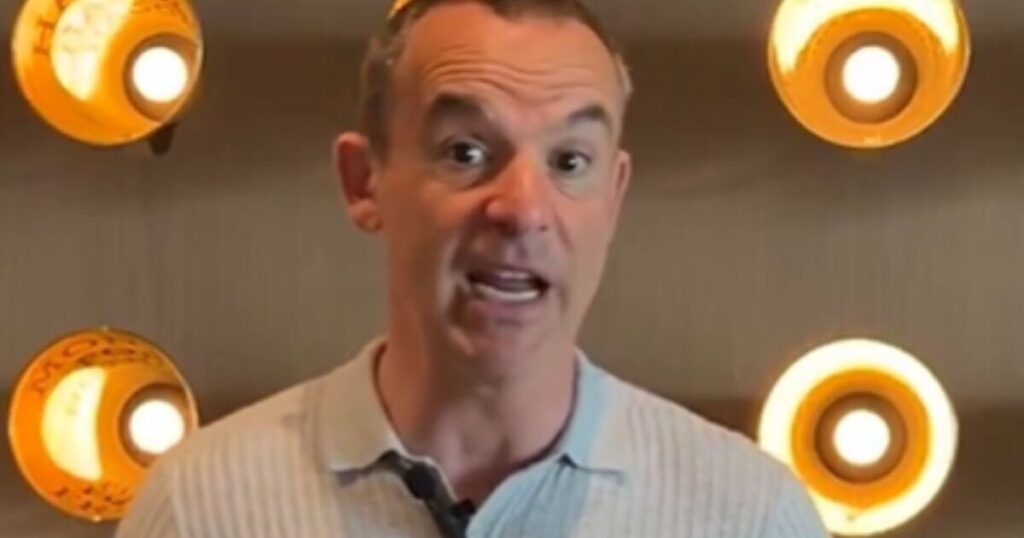

Brits looking to lock their money into a fixed rate savings account should do it “today”, Money Saving Expert Martin Lewis said.

The Bank of England cut the base rate from 4.5% to 4.2% last week, and savings providers are usually quick to trim the interest rates they have on offer, too. With this in mind, those who have been holding off fixing an interest rate would be wise to do it now, according to the money guru, as returns aren’t likely to get better than they are today. Taking to his Money Podcast on Sunday, Mr Lewis told listeners: “We’re going to see easy access rates, both the ones being offered and your existing accounts, coming down. Fixed rate savings tend to factor in future interest rates, so they’re already lower than the easy access interest rates as they’ve factored in much of the [Bank of England] cuts. But here’s the key thing. If you’re looking to fix, I would be fixing today.”

Mr Lewis explained that savings providers tend to operate fixed rate savings accounts by offering a tranche.

For example, they’ll offer £5million worth of savings at 4.6%. Once it reaches £5million, it will look to re-establish what its new fixed rate will be. Mr Lewis said: “So, you may be able to get in now before the rate drops and they reassess based on the new information.”

He added: “And of course, because it’s a fix, your rate is locked in.”

Fixed rate savings accounts enable people to lock in the interest rate offered at the point of opening for a specified period of time, typically between one to five years. However, they tend to be stricter than other savings accounts as minimal to no withdrawals are allowed until the term ends.

Mr Lewis said: “The safest bet is to [fix] today. And also as a general point, analysts are predicting that interest rates are going to come down quite substantially over the next year.

“If you’re risk-averse to rates going much lower and you don’t need access to the money, then the safest thing to do if you’ve got savings is to lock it away in the highest rate fix you can get right now, which will protect you from interest rates dropping.”

He added: “I can’t promise anything, we live in such an uncertain world, but the risk-averse thing now is if you’ve got savings and you want to keep a higher rate, would be to lock them in on a fix.”

Markets have priced in at least two more Bank of England Base Rate cuts before the end of the year. Here are the top fixed rates available at the time of writing, according to Moneyfactscompare.

Latest World Breaking News Online News Portal

Latest World Breaking News Online News Portal